If your goal is too long, you risk dragging it out or getting overwhelmed too short, and you may add unwanted pressure.

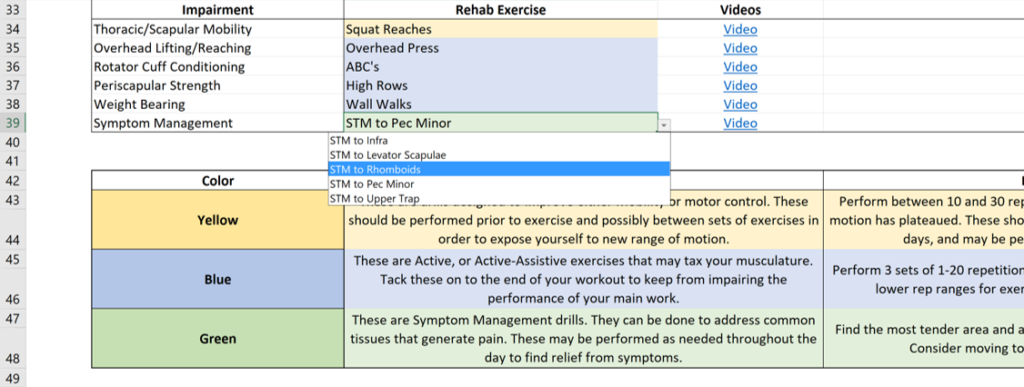

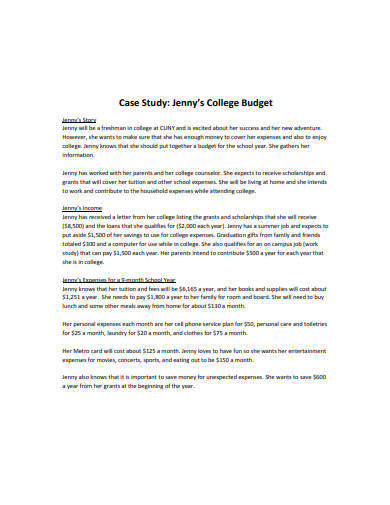

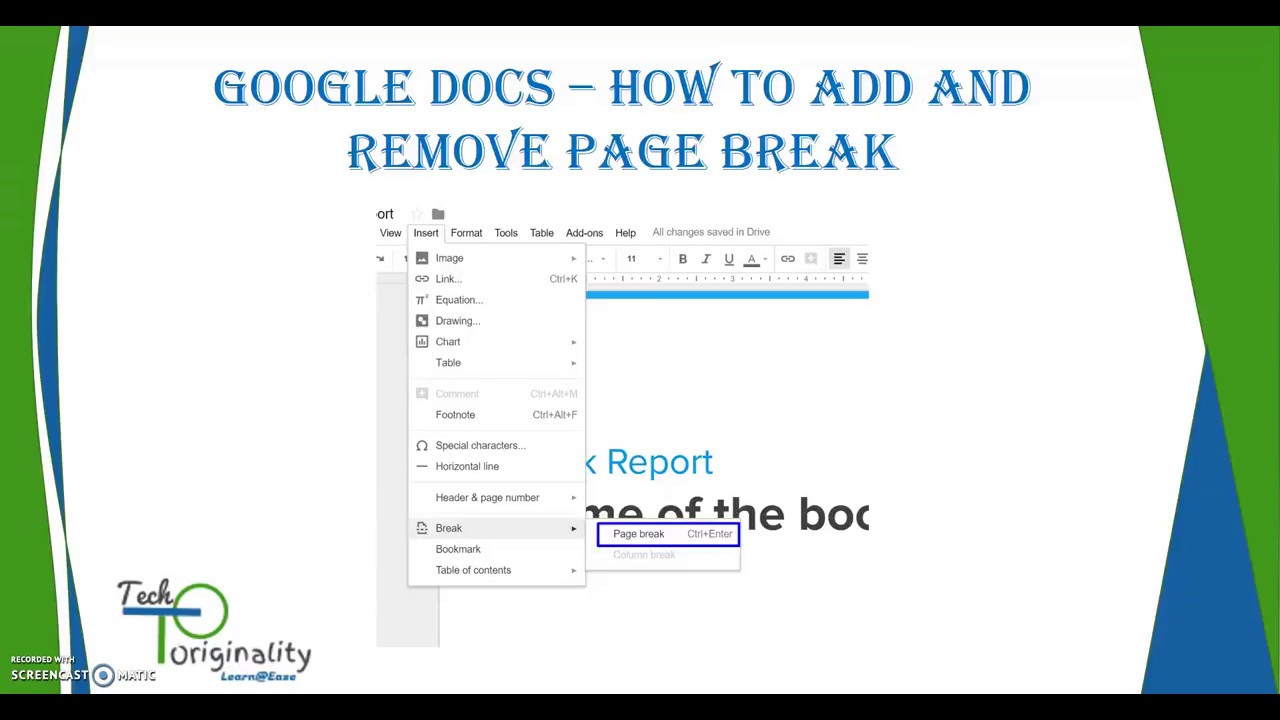

Check in daily to ensure you stay on top of your goals.Make sure any columns you add are relevant and won’t simply create an extra step.Move your completed goals to another sheet, or hide the row they’re in by right-clicking and selecting Hide.Limit the number of goals you set for the same reason-but also to avoid burnout.Track your current goals only to keep things neat and tidy.Here are some tips to help you set and track your goals in Google Sheets: Tips for Tracking Your Goals in Google Sheets Daily-how can you track your goal daily?.Timeline-how long do you want it to take?.Objectives-what will you do to get there?.This is where walking more becomes walking 100 miles, or learning to code, building your first webpage. Goal statement-what do you want to do? Be specific so that you’ll know when you’ve achieved it.

These columns will help you map out your goals, almost like prompts, to help you answer the following questions: To get started, add the following titles to the top: But you can make this goal template your own, from how you set your goals to how you review your progress.Īs you follow the steps in this guide, think of features or columns you would add or change to make the template your own. Some goal-oriented apps use pre-determined templates that might not apply to you or your objectives, and others are meant for specific goals only, requiring you to use more than one. Upto 1.50% of the principal outstanding and undisbursed amount (if any) + applicable taxes/statutory levies at the time of conversion.Goal-setting is best kept simple. Switch to Lower Rate (Loans under HDFC Bank Reach)- Variable Rate Switch to Lower Rate (Plot Loans)- Variable RateĠ.5% of principal outstanding and undisbursed amount (if any) + applicable taxes/statutory levies at the time of Conversion. Switch from Combination Rate home loan fixed rate to Variable rateġ.75% of the Principal Outstanding and Undisbursed amount (if any)+ applicable taxes / statutory levies at the time of Conversion. Upto 0.50% of the Principal Outstanding and undisbursed amount (if any) at the time of Conversion or a cap of Rs.50000/- + applicable taxes / statutory levies whichever is lower. Switching to Variable Rate Loan from Fixed Rate Loan (Housing/Extension/ Renovation)

Upto 0.50% of the Principal Outstanding and undisbursed amount (if any)at the time of Conversion or a cap of Rs.50000/-+applicable taxes/statutory Levies which ever is lower. Switch to Lower Rate in Variable rate Loans (Housing/ Extension/ Renovation) 2000/- + applicable taxes / statutory levies. Re-appraisal of loan after 6months from date of sanction 3000/-+applicable taxes/statutory levies whichever is higher Minimum Retention Amount: 50% of applicable fees or Rs. Up to 2.00% of the loan amount+ applicable taxes / statutory levies. 4500/-+applicable taxes/statutory levies whichever is higherįees for Loans under HDFC Bank Reach Scheme 4500/- whichever is higher + applicable taxes / statutory levies and charges. 3000/- whichever is higher + applicable taxes / statutory levies and charges. +applicable taxes/statutory levies whichever is higher 4500/- whichever is higher+ applicable taxes / statutory levies. 3000/- +applicable taxes/statutory levies whichever is higherįees for Resident Housing/ Extension/ Renovation/ Refinance/ Plot Loans for Self Employed Non-Professionals. 3000/- whichever is higher + applicable taxes / statutory levies. Fees for Resident Housing Loan/ Extension/ House Renovation Loan/ Refinance of Housing Loan/ Plot Loans for Housing (Salaried, Self-Employed Professionals)

0 kommentar(er)

0 kommentar(er)